Ethereum is gently gaining momentum

Ethereum is gently gaining momentum, Ethereum Gains Momentum: Ethereum rises 2.8% in the last 24 hours, showing resilience and outperforming most altcoins. Driven by favorable market conditions and increasing inclusion in diversified portfolios, ETH is recovering steadily. Learn how ETFs and macroeconomic factors are impacting Ethereum’s performance in a volatile crypto market.

Market Picture

Switch to FXPRO today and trade cryptocurrencies like a savvy

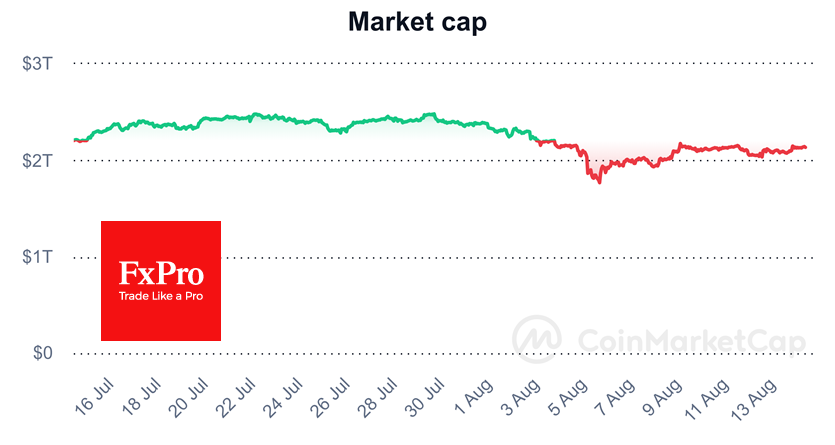

The cryptocurrency market added 2.2% in the last 24 hours to reach $2.14 trillion, a fresh attempt to

climb into the upper half of last month’s trading range from where last week’s sell-off was intensified.

Over the past 24 hours, the macroeconomic background has been favourable for risk appetite thanks

to slowing producer prices and New Zealand’s key rate cut.

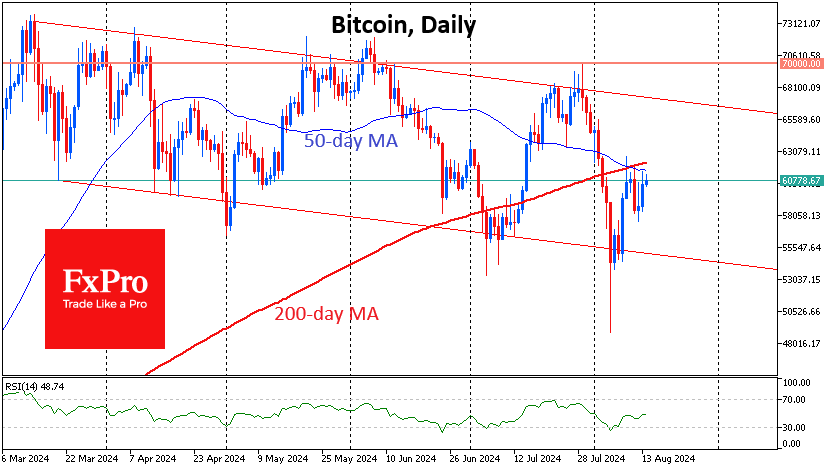

Bitcoin remains at arm’s length from the $61K level, continuing to test the 50-day moving average and

adding 2.5% in 24 hours. We assume a high correlation between Bitcoin, the entire crypto market and

the dynamics of the stock market. Data supporting the Fed’s imminent easing of monetary policy may

encourage the bulls to overcome the short-term downtrend and give the green light to rise all the way

to $66K. Nevertheless, a new sell-off momentum is still the prevailing scenario, with a potential

pullback to $55K.

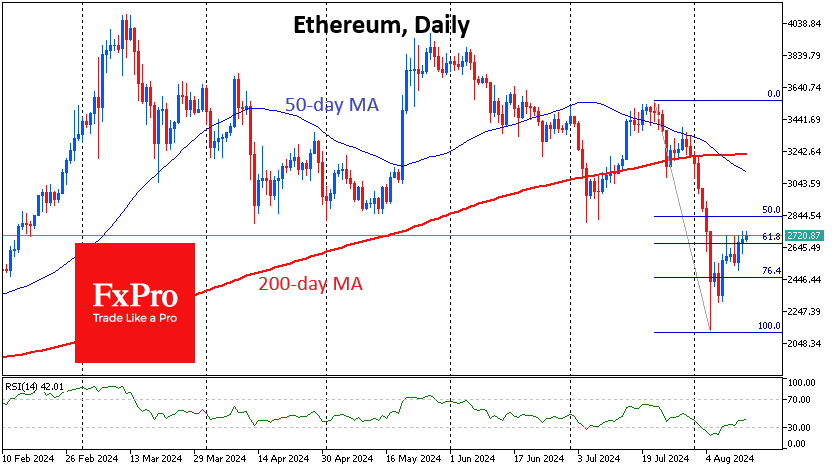

With Ethereum as an example, we can see how ETFs perform in the early stages. The coin is

recovering better than other altcoins, adding 2.8% on the day to $2730. ETHUSD is vulnerable to

equities sell-offs but benefits more from inclusion in portfolios of investment managers seeking broad

diversification.

News Background

BRN is cautious about Bitcoin’s outlook and recommends using the pullback to increase positions

gradually. Volatility will continue in August and September, with BTC fluctuating between $49K and

$69K.

Bitcoin may leave the established corridor due to the upcoming Fed rate cut and the US election,

FalconX believes. A sustained rally in altcoins will require improved liquidity narratives and trends, as

well as the removal of potential selling pressure from early investors.

Switch to FXPRO today and trade cryptocurrencies like a savvy

The US SEC accused NovaTech’s founders and promoters of organising a Ponzi scheme that raised

more than $650 million in crypto assets from more than 200,000 investors worldwide.

Japanese public company Metaplanet announced the purchase of 57.1 BTC for 500 million yen

(~$3.3 million), bringing the company’s total Bitcoin holdings to 303,095 BTC ($18 million).

As noted by Arkham, Custodian BitGo moved 33,140.4 BTC (~$1.97 billion) related to the collapsed

Mt. Gox. It is the last of five platforms working with a trustee to distribute funds to creditors. The

addresses of the collapsed platform still hold 46,164 BTC worth $2.75 billion.

The liquidators of cryptocurrency hedge fund Three Arrows Capital (3AC) have demanded at least

$1.3 billion from Terraform Labs, the company behind the Terra ecosystem. One of the industry’s

most prominent hedge funds collapsed shortly after Terra and several other major crypto companies

collapsed in 2022.