Oil: the lost positive link

Oil: the lost positive link, Oil Market Analysis: WTI oil prices have fallen in four of the last five sessions, with bearish pressure intensifying near $78. The breakdown in the positive correlation with equity indices, coupled with weak drilling activity and historical highs in gold, marks a shift in the oil market. Technical factors suggest that the 200-week moving average could become a resistance level, with potential for a pullback to $70 by month-end. Explore the latest trends and technical insights in the oil market.

Oil: the lost positive link

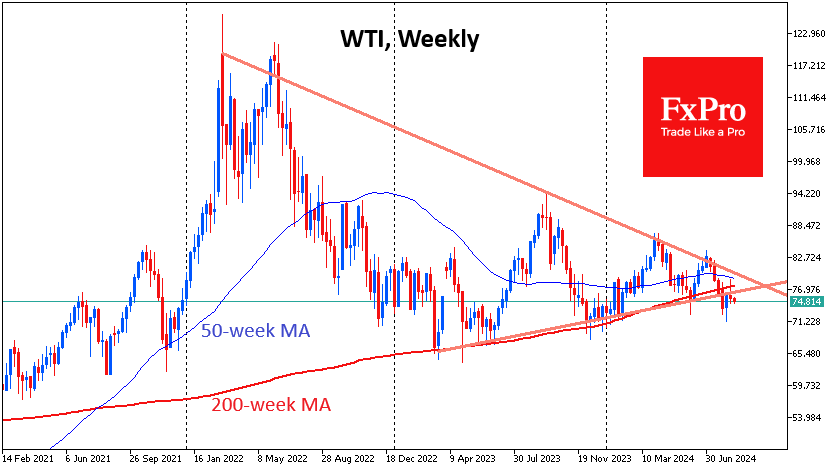

The cost of a barrel of WTI has fallen four out of the last five sessions, underlining the dominance of

the bears. Selling is intensifying as the price rises above $78, which is close to important technical

levels.

Last week, oil failed to maintain the positive momentum of the beginning of the month and fell due to

active selling. The positive correlation between oil and equity indices broke down, with oil falling while

equities posted their strongest gains in months. This was accompanied by a weakening dollar and

historic highs in gold, the traditional companions of an oil bull market.

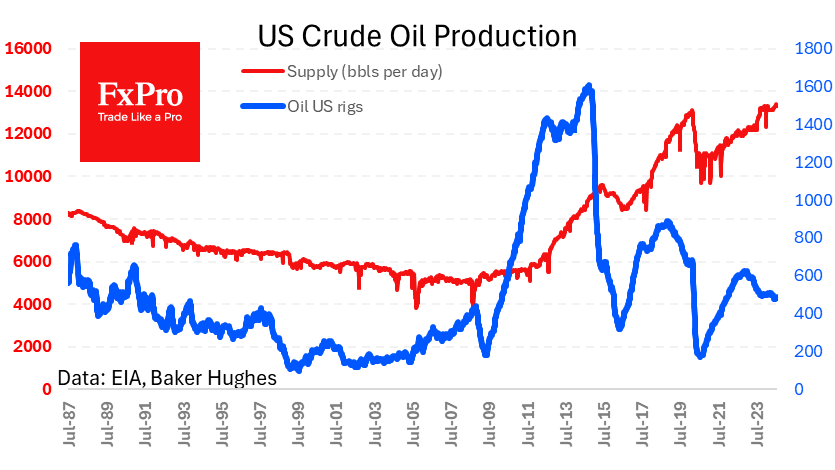

Drilling activity remains weak, with the oil rig count falling from 485 to 483 last week, and including

natural gas, from 588 to 586. Oil supply fell from a record 13.4 million bpd to a more familiar 13.3

million bpd. Producers are maintaining maximum output with historically low drilling activity, more

likely due to a reluctance to invest in production expansion rather than actively increased efficiency.

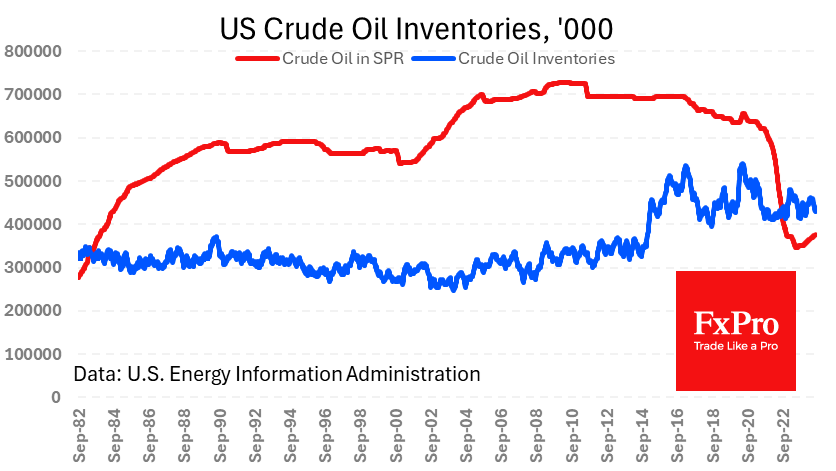

Commercial crude oil inventories are 2% lower than a year ago, which is within the normal range of

fluctuations and has no visible impact on prices. Buying continues in the strategic reserve, which is up

8.5% from its lows of just over a year ago but remains 42% below its four-year low. At the current

pace of buying, it would take almost ten years to bring the strategic reserve back to its early July 2020

level.

Subdued upstream investment, reserve replenishment and increased buying in related markets have

failed to turn the tide against oil. Technical factors continue to dominate. At the beginning of last

week, oil was above its 200-week moving average. At a high of $78.7, the price approached the 50-

week moving average ($79.1). However, the weekly close was negative, and the decline continued

Monday.

Switch to FXPRO today and trade energy commodities like oil like a savvy trader.

The 200-week moving average, which has been a strong support level for the past three years, now

has a high probability of becoming serious resistance. At the end of July, oil broke out of the

consolidation trend that had been forming since April 2022. An unsuccessful attempt to move higher

could intensify selling and become an indicator of a reversal in the long-term trend.

In the short term, we are watching the bearish corridor that has been in place since April. Within this

trend, a move to the lower boundary suggests a pullback to $70 by the end of the month.

Switch to FXPRO today and trade energy commodities like oil like a savvy trader.