S&P500 risks correction ahead of US election

S&P500 risks correction ahead of US election: Anticipating a potential S&P500 correction ahead of US election. Examine the market trends, volatility, and risks impacting key indices. Stay informed for the latest updates.

S&P500 risks correction ahead of election

The US S&P500 and Dow Jones indices closed lower on Monday and Tuesday. The Nasdaq100 has followed suit lately. The Russell 2000 index of small public companies lost for four consecutive sessions. There are signs that we are now seeing the beginning of a correction like the one we saw in August. There is also the risk of a bear market beginning.

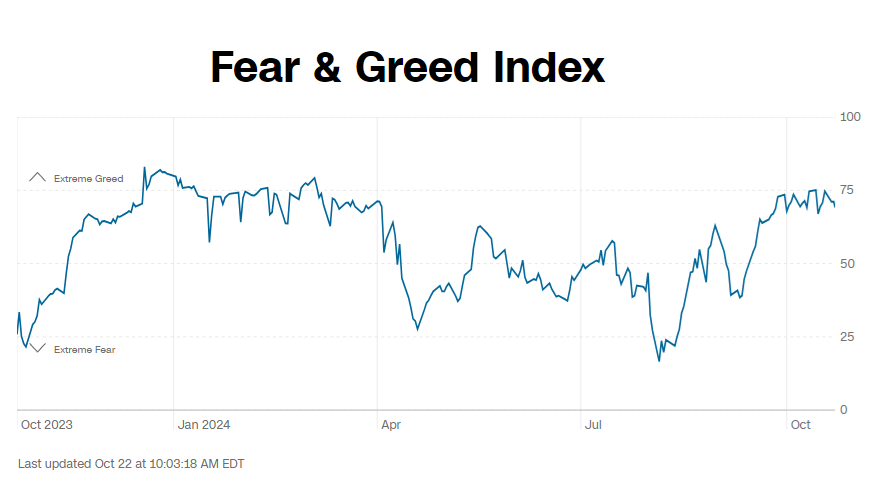

CNN’s Fear and Greed Index has been mostly in the 70-75 range since late September – on the cusp of extreme greed. A market correction often accompanies a pullback from current highs into neutral territory.

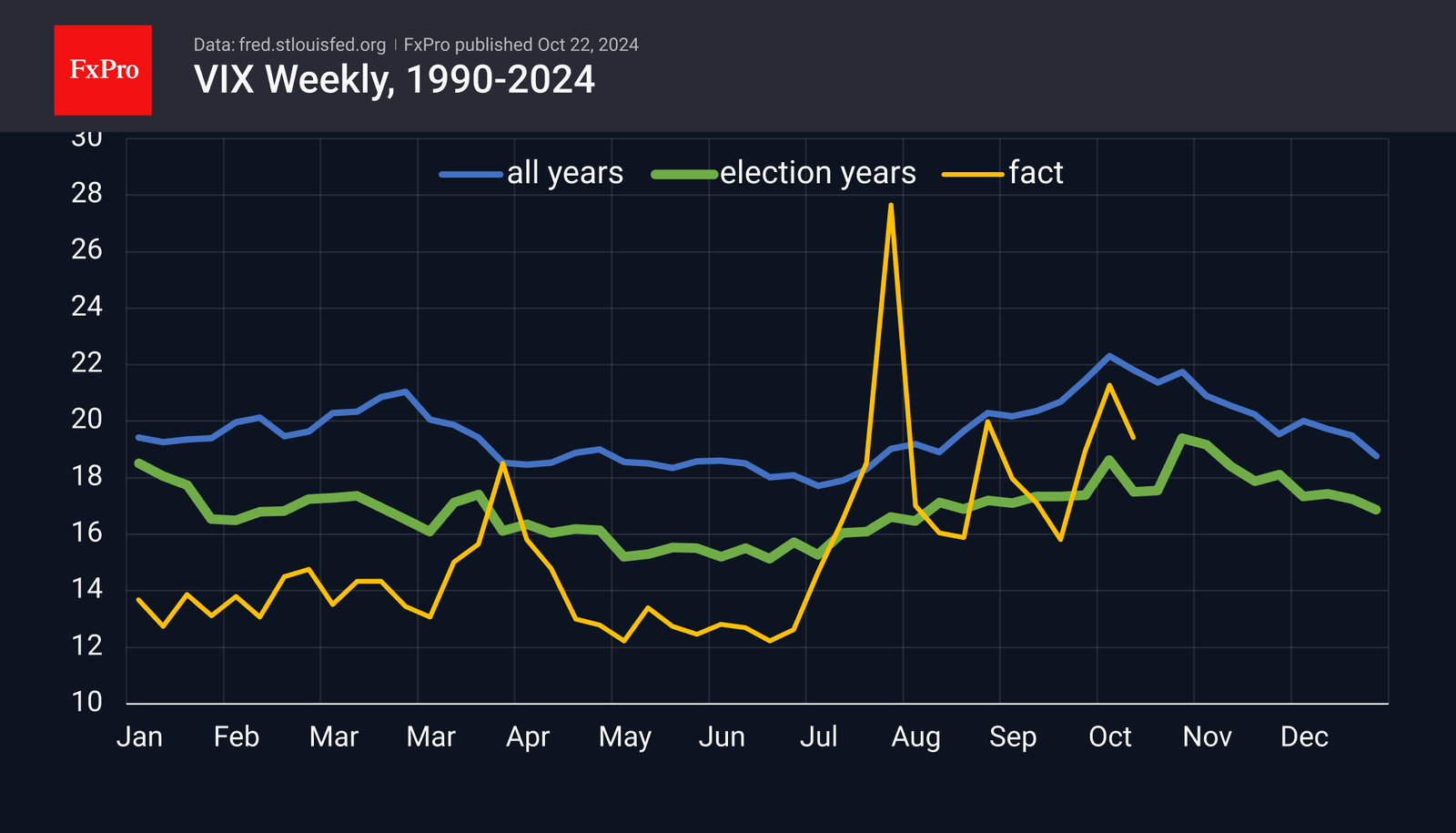

The VIX volatility index jumped above 20 in early October, indicating heightened nervousness, which is unusual in situations where historical highs are being systematically updated. Historically, however, current levels are lower than typical for this time of year, although slightly higher than in US presidential election years.

Let’s look at the dynamics rather than the absolute levels of the VIX. We are entering an important period of highest volatility, covering the week before and the week after the election. Volatility is often synonymous with falling markets.

This decline also looks logical, given the typical pre-election uncertainty. This time, it is prolonged in the US due to a very close race between the candidates, with no clear winner yet. Separately, we look at the RSI and price divergence for the S&P500: the price is well above the July peak, while the Relative Strength Index peaked at 70 at the beginning of last week and has already fallen back to 59.

The risks for financial markets in the coming weeks are, therefore, tilted to the downside. Using the Fibonacci pattern, the 5600-5700 area for the S&P500 is a potential correction target if the markets do not dig deeper.

Sign up with FXPRO today and trade financial markets like a savvy trader