Gold tries to break out of a triangle

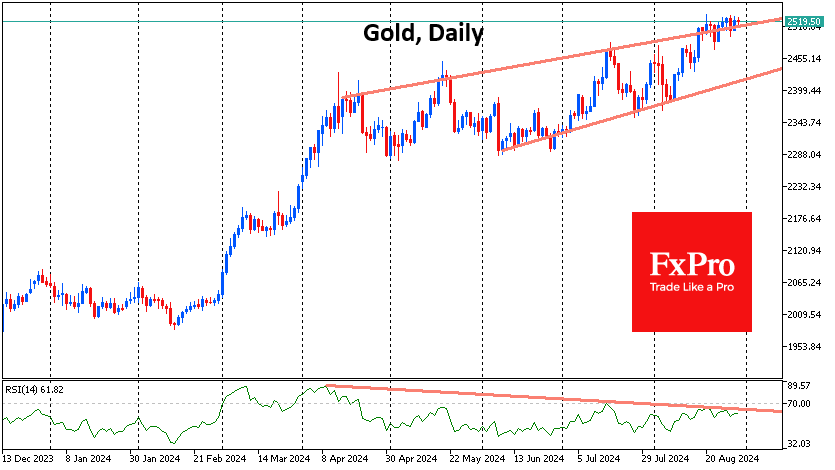

Gold tries to break out of a triangle: Gold nears a breakout from a triangle pattern, testing $2525 resistance with rising support. Buyers are taking the initiative as the price consolidates near historical highs. Key drivers include dollar weakness and upcoming Fed decisions

Gold tries to break out of a triangle

Gold has hit a glass ceiling at $2525 an ounce on the spot market, which it has been battling against

for the past two weeks. A series of smaller and smaller pullbacks and more frequent rallies to the

resistance indicate impressive buying pressure. Under these conditions, we should expect a breakout

to the historical highs soon, but it will be important to watch how the price behaves afterwards.

Over the past two weeks, a triangle of horizontal resistance and rising support has formed on the gold

chart. This is a clear indication that buyers are taking the initiative at increasingly higher levels.

The same conclusion can be drawn if we look at the longer-term chart period since April, when the

trend of increasingly shallow corrections continued. The current consolidation is an oscillation around

the upper boundary of the uptrend since then.

Switch to FXPRO today to trade gold like a savvy

In the daily timeframe, we continue to see a divergence between the RSI and the price trend, which is

a sign of upward exhaustion. However, we saw a similar situation from October 2023 to February

2024, which was followed by a strong uptrend rather than a short-term uptrend.

One of the main drivers of the gold price over the past two months has been the dollar near 5%

weakness against a basket of major currencies, which largely explains the 8.5% appreciation in the

ounce. However, we note that the DXY is attempting to reverse its direction to the upside as it

reaches the lower end of its trading range in early 2023.

Together, these signals point to a likely near-term break of resistance with a renewal of historical

highs, which could be followed by a medium- or even long-term reversal in the dynamics of the gold

price.

If we take a look beyond the charts, gold’s short-term fate will be determined by the Fed's monetary

policy outlook: how much it will cut interest rates before the end of the year. The monthly Employment

report on September 6th and the CPI on the 11 th will help clarify the answer.