Government Bitcoin Sales Weigh on Prices

Government Bitcoin Sales Weigh on Prices, Government Bitcoin Sales Impact Prices: Bitcoin prices face downward pressure as U.S. government Bitcoin sales contribute to increased supply and psychological caution. Despite early-day gains, Bitcoin’s technical outlook remains bearish, with further declines expected. Learn how market conditions and government sales weigh on cryptocurrency prices.

Market Overview

Connect with FXPRO today and trade your favorite crypto assets with lower costs and low-latency connectivity

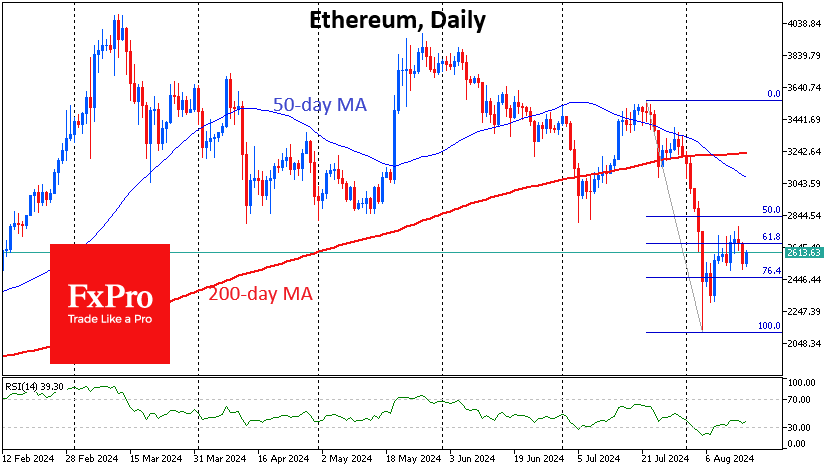

The positive sentiment in stock markets has yet to spill over into cryptocurrencies due to selling

pressure. The Crypto Fear and Greed Index dropped two points to 27 (fear). Thursday’s active

recovery in stocks was met with Bitcoin and Ethereum sales, which at their lowest point on Thursday

approached $56K and $2500, respectively, following reports of new Bitcoin sales from U.S.

government wallets. Friday started positively, with the prices of these cryptocurrencies rising by more

than 2.5% since the beginning of the day.

Despite the early-day growth, the technical picture for Bitcoin remains bearish, with higher chances of

further price decline. A significant fundamental factor remains the sales from U.S. government wallets.

Besides the natural effect of increased supply in large blocks, the psychological effect must be

considered, causing buyers to wait for the end of the sell-off or speculate about the risks of regulatory

tightening.

News Background

As a result of the latest recalculation, the mining difficulty of the first cryptocurrency decreased by

4.19% to 86.87 T. The average hash rate for the period since the previous change was 740.3 EH/s.

Arkham recorded that U.S. authorities transferred 10,000 BTC ($580 million) to Coinbase from their

holdings of 203,239 BTC and other cryptocurrencies worth approximately $12.22 billion.

According to Ultrasound.money, the supply of Ethereum exceeded 120 million coins. This was

facilitated by the growth of coins locked in staking and restaking protocols. The annual inflation of

Ethereum increased to 0.69%.

Major mining company Marathon Digital announced the acquisition of 4,144 bitcoins worth $249

million. The total number of BTC in the company’s wallets now exceeds 25,000 coins.

K33 Research shows that Norway’s sovereign wealth fund increased its bitcoin portfolio from 1,507 to

2,446 bitcoins since the beginning of the year, using a risk diversification strategy.

According to Bitwise, based on SEC filings, 44% of asset managers increased their investments in

spot bitcoin ETFs in the second quarter, while another 22% maintained their previous position

volume. 21% of companies reduced their investments in BTC ETFs, and 13% liquidated them. During

this period, the value of BTC fell by 14.5%.

Bybit reports that the bullish trend of the first cryptocurrency should continue until the third quarter of

2025. The level of retail investor participation in the current cycle has decreased; institutional

investors are driving the growth of bitcoin prices.

Connect with FXPRO today and trade your favorite crypto assets with lower costs and low-latency connectivity