Oil Tests Crucial Support

Oil Tests Crucial Support: Oil tests a crucial support level as prices dip over 4% amid stock market rally and news of Saudi Arabia’s shift from $100/barrel price targets. Explore how past events in 2020, 2014, and 2008 parallel today’s market dynamics and why Brent’s $70 support could be pivotal.

Oil Tests Crucial Support

Oil has lost more than 4% in two days despite the development of a rally in stock markets. The most

important news for oil is an article in the FT that Saudi Arabia plans to abandon price targeting at

$100 per barrel and intends to increase production. This is similar to the events of early 2020 when,

after prolonged OPEC+ coordination, Russia and Saudi Arabia decided to join the fight for market

share, which we were quickly taking away.

This news is just as important as in 2014 and 2020 when we saw similar course-changing episodes.

Even earlier, in 2008, oil also went into freefall mode when it similarly became too plentiful for the

economic conditions at the time. In all three cases, the price after the freefall fell into the $30 area.

So why did oil not go straight into freefall upon the release of such news? There are several reasons.

Firstly, this news needs to be confirmed. The freefall in 2020 and 2014 started after the OPEC

meetings when the change of targets was announced publicly and officially.

Second, America is replenishing depleted oil reserves, making the process a regular occurrence with

the price of a barrel of WTI near $70.

switch to fxpro today and trade brent oil like a savvy

switch to fxpro today and trade brent oil like a savvy

Third, the U.S. economy maintains a strong growth rate and market optimism is fuelled by speculation

that China’s stimulus will boost the economy and commodity prices, including oil.

Fourth, America has been very sluggish in ramping up production and has not invested much in

developing new wells. This suggests that if the price falls, the supply from the US could start to

dwindle quite quickly.

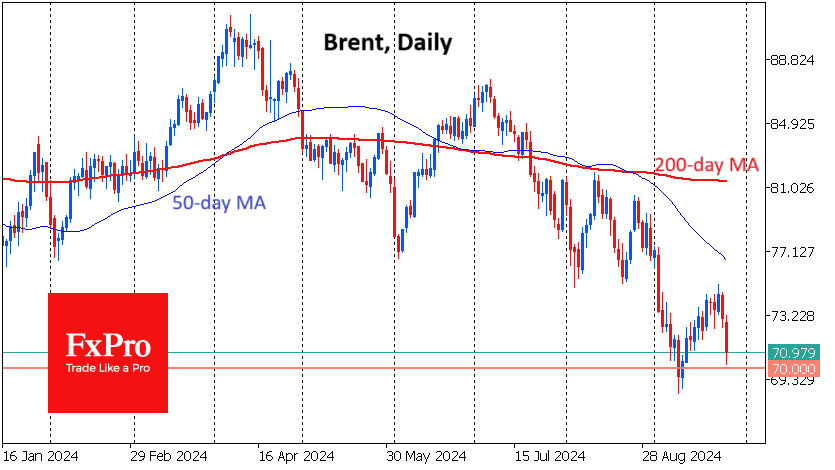

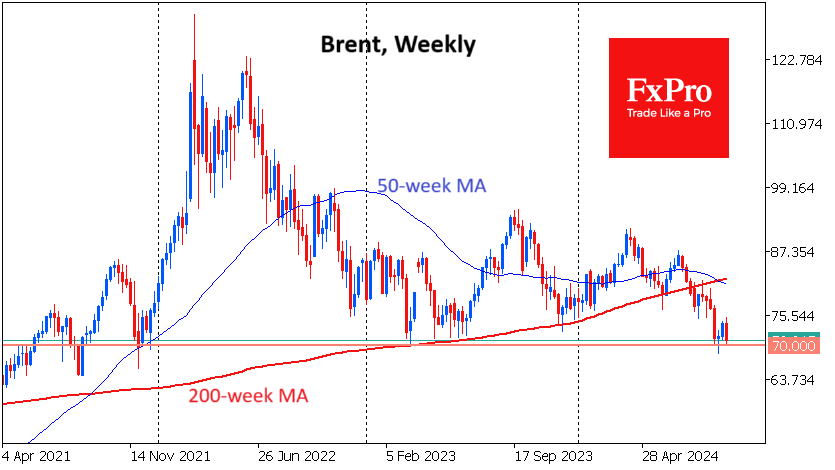

A new drop in the $30 area looks possible, but it is a very pessimistic scenario. Technically, the Brent

price is testing support near $70, which was the 2023 low and reversed the price to the upside.

However, the 200-week average, which is now at $82.1, also provided support, and further declines

accompanied a dip below it in July.

Testing the area of last year’s lows is the most important frontier. A failure of Brent below $70 could

trigger a freefall. But for now, we cannot rule out the possibility of a rebound.