Promising upturn in US indices

Promising upturn in US indices:US indices show promising recovery after August inflation data. The Nasdaq 100 rallies beyond a 2% decline, signaling strong buying interest. S&P 500 and Dow Jones close above key moving averages, indicating bullish momentum ahead

Promising upturn in US indices

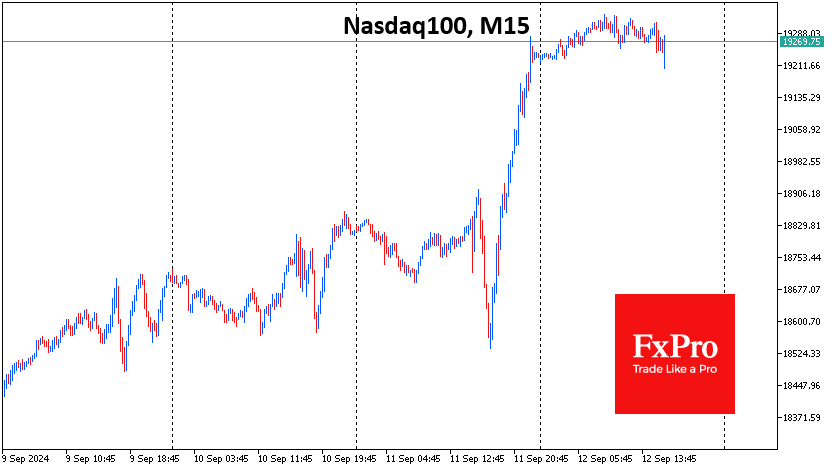

US inflation in August was in line with expectations but caused some interesting market movements. The initial reaction was neutral, but then markets began reassessing expectations for the Fed Funds rate. The shift in expectations towards a 25bp cut rather than a 50bp cut in a week’s time initially triggered a wave of selling in risk assets.

However, sentiment soon changed dramatically, allowing the Nasdaq100 to not only recover from a 2% peak-to-trough decline but also to rise by more than 2%. The gradual slowdown in inflation does not suggest any abrupt changes.

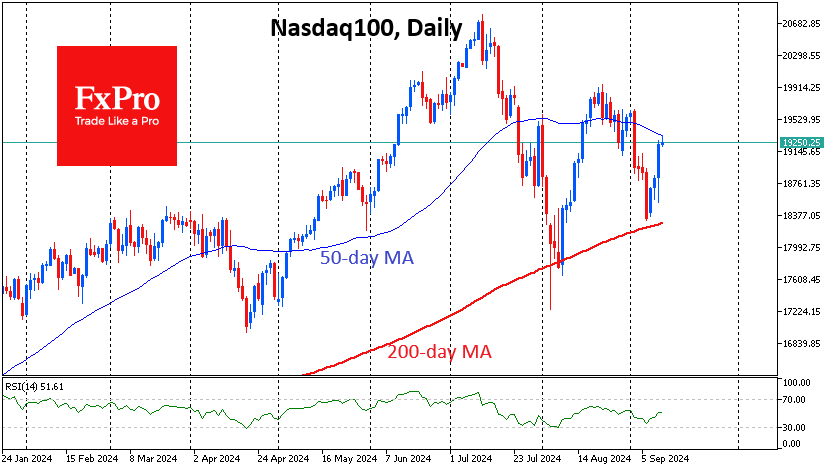

The technical picture of the indices is promising for the bulls. The Nasdaq 100 index is rallying sharply for the second time since early August as it approaches its 200-day moving average. A bullish engulfment pattern has formed on the candlestick chart, reflecting the market’s intraday reversal on Wednesday. The sharp reversal indicates strong buying interest on the downside.

Get connected with FXPRO and trade indices like a savvy trader

It is not hard to understand why, as August’s labour market concerns fade into the background, we are seeing a ‘nice’ slowdown in price growth that is not linked to a slowdown in US economic activity but simply a normalisation of growth rates.

The S&P500 and Dow Jones closed above their 50-day moving averages on Wednesday after initially falling on the inflation data. The VIX volatility index moved back below the 20 mark, marking a return to the steady gains we’ve seen since the end of last year.

For the Nasdaq100, a key near-term technical hurdle is the 50-day moving average, which the index approached on Thursday. A break above it would signal a readiness for further gains and a retest of all-time highs.