Slowing inflation in Germany and Italy could soften ECB’s bias

Slowing inflation in Germany and Italy could soften ECB’s bias: Inflation in Germany and Italy is slowing faster than expected, potentially paving the way for aggressive ECB rate cuts. As eurozone CPI falls toward the ECB’s target, expectations build for a softer ECB stance compared to the Fed’s hawkish approach. Discover the impact on EURUSD and eurozone economic outlook

Slowing inflation in Germany and Italy could soften ECB’s bias

Sign up with FXPRO today and trade the financial markets like a savvy pro!

Inflation in Germany and Italy is slowing faster than expected, setting the stage for a slowdown in the eurozone as a whole and clearing the way for further and more aggressive rate cuts.

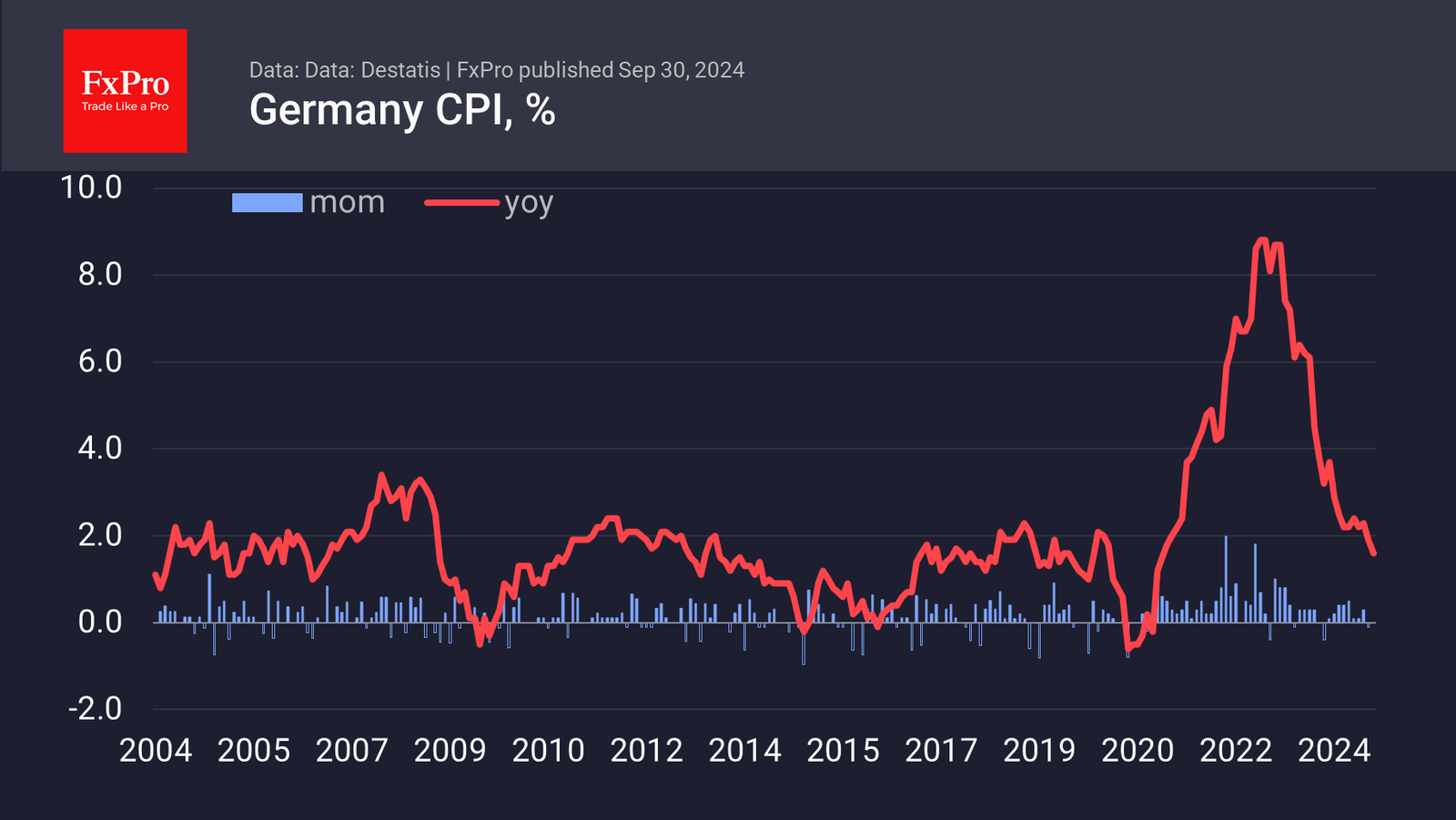

Germany’s consumer price index slowed to 1.6% year-on-year, virtually unchanged in September, according to a Destatis estimate released on Monday. On average, analysts had expected a slowdown to 1.7% from 1.9% in the previous month.

The pace of consumer price growth in Italy was even more subdued at 0.7% y/y versus 1.1% the previous month and 0.8% expected. This was the first monthly decline of 0.2% since November last year.

The ECB describes its inflation target as “below, but close to 2%.” At the end of last week, the average analyst forecast was for the eurozone CPI to fall to 1.9%. Downside risks have increased following the Italian and German data, which could formally pave the way for further downgrades by the ECB.

However, it is interesting to note that so far, the market is expecting less action from the ECB (25-50 points lower by the end of the year) than from the Fed, where it is expecting another 75-100 points lower at the next two meetings. The central bankers of the most influential economies do not like to surprise the markets, so they will either change their rhetoric to meet market expectations or try to manage expectations.

In our view, we should expect the ECB to soften its rhetoric, supported by softer inflation data and active rate cuts by its main rival, the Fed. If we are right, EURUSD has the potential to retreat from the 2.5-year highs around 1.12 to 1.10, recharging the bulls.