The crypto market attracts money, but prices don’t rise

The crypto market attracts money, but prices don’t rise. Crypto Market Overview: The crypto market capitalization slightly increased to $2.07 trillion, yet struggles with resistance at $2.15 trillion. Despite record stablecoin growth and Bitcoin’s rising dominance, Litecoin faces persistent selling pressure. Explore the current market trends, Bitcoin’s dominance, and the implications for future price movements

Switch to FXPRO today for an unrivaled trading experience in the crypto market.

The crypto market attracts money, but prices don’t rise

On Monday morning, the crypto market capitalisation stood at $2.07 trillion, up slightly from $2.05

trillion a week earlier. In the previous two weeks, the market failed to rally above the $2.15 trillion

level, which has become a local resistance. The weakness in the crypto market undermines our

confidence in a global recovery in risk appetite, even though last week was the strongest week for US

equity indices in many months.

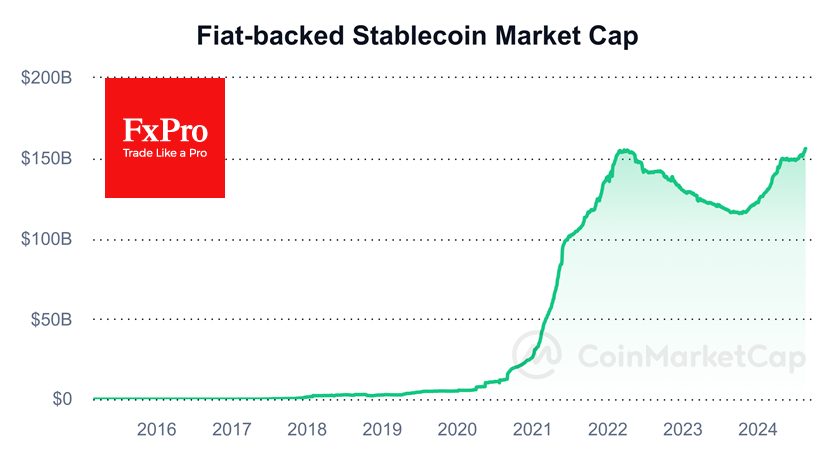

Interestingly, the sell-off from local resistance in the crypto market over the past two weeks has been

accompanied by a surge in stablecoin capitalisation to new records after a prolonged sideways period

from April to the end of July. Typically, the growth in stablecoin volume coincides with the bullish

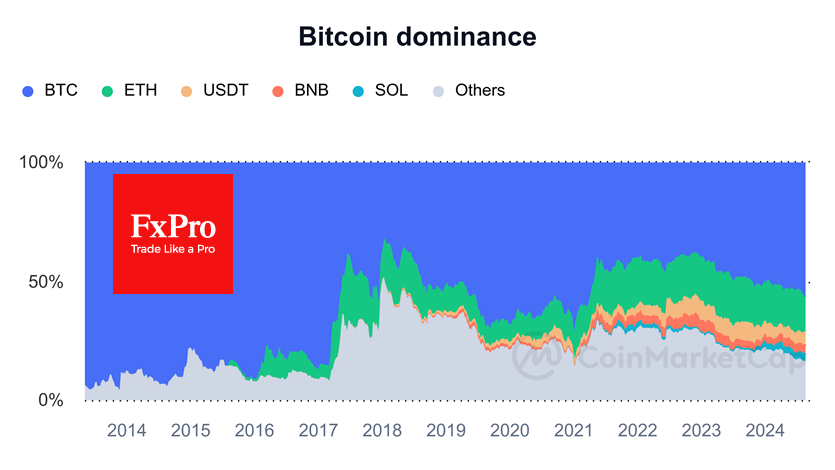

phase of the market. The crypto whales buy on dips, and it is clear from Bitcoin’s dominant dynamics

that their focus remains on the first cryptocurrency, whose market share has risen to 56.5% – the

highest since April 2021.

Litecoin’s dynamics illustrate what is happening in cryptos, except for the largest coins. Again, it’s

mostly selling on growth. Litecoin fell sharply below its 50-day moving average in April and has been

selling off on approaches to this line for the past four months. On Sunday, this downtrend touched

again at around $67. An intensification of the negative trends could send the price to $56 (the area of

the previous uptrend reversal) or even trigger a major liquidation with a slip below $50.

News background

According to SoSoValue, the spot bitcoin-ETFs saw modest total inflows of $32.6 million last week

after two weeks of outflows. In contrast, the Ethereum-ETF saw net outflows of $14.2 million last

week, with net outflows of $0.42 billion since the products were approved, compared to $17.37 billion

for Bitcoin ETFs.

According to Bitcoin Magazine, nearly 75% of all Bitcoins in circulation have been inactive for more

than six months, reflecting a hoarding trend. Factor LLC CEO Peter Brandt said Ethereum on the

four-hour chart is ‘signalling’ a possible drop to $2,000 or even lower.

Bernstein gave shares of mining companies Riot Platforms, CleanSpark, IREN and Core Scientific an

Outperform rating on the market. The IMF proposed an 85% increase in energy tariffs for bitcoin

miners globally, which could significantly reduce carbon emissions.

Artificial intelligence-related crypto projects could fail due to the potential ‘collapse of the bubble’ in

the sector, according to Blockcircle. AI in cryptocurrency is ‘largely fashionable,’ although there has

been little real-world application of neural networks in the crypto sphere.

The absence of US Democratic presidential candidate Kamala Harris from the Crypto for Harris event

has led the community to question her support for the crypto industry.

Chainalysis noted that attackers stole cryptos worth nearly $1.6 billion in the first half of the year,

increasingly targeting centralised exchanges (CEX). The figure nearly doubled compared to the same

period in 2023.