The Crypto Market’s Steady Ascent

The Crypto Market’s Steady Ascent: The crypto market experiences a robust 3.2% rise, reaching a total capitalization of $2.21 trillion as active buying propels it toward breaking previous local highs. Bitcoin tests the crucial 200-day moving average, aiming for resistance levels at $66K and potentially higher. Solana rallies 20% following favorable market sentiment, with support from major players like BlackRock, which highlights Bitcoin as a hedge against global risks. Meanwhile, developments in cryptocurrency adoption by states and banks enhance the market landscape

The Crypto Market’s Steady Ascent

Trade crypto with FXPRO today

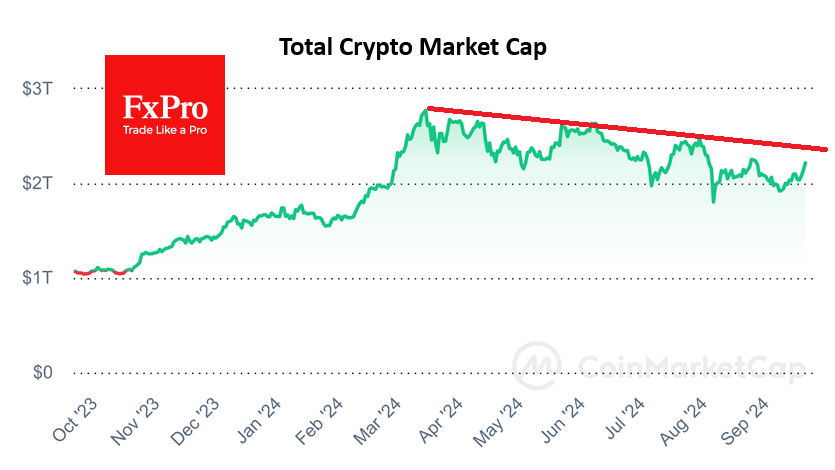

Active buying continues in the crypto market, with its total cap rising 3.2% in 24 hours to $2.21 trillion, reviving the fight to break the previous local high of $2.27 trillion a month ago. The local low in early September was above the previous low, and a break of the recent highs could provide fresh buying momentum and signal a break in the multi-month downtrend.

Bitcoin broke above $64K on Friday morning and is fast approaching a test of the emotionally important 200-day moving average, which also holds the late August highs. Overcoming this resistance would open the way to the upper boundary of the descending channel at $66K and a break of the downtrend on the rise above $68K.

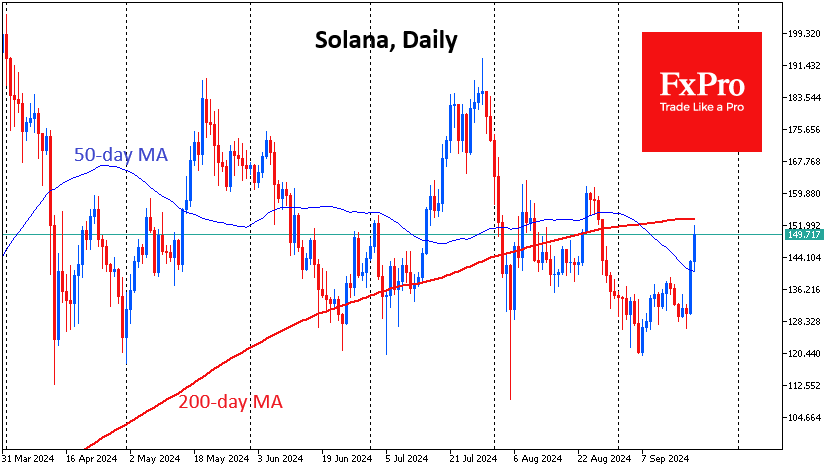

The turnaround in market sentiment has helped Solana, which has rallied around 20% from the lows seen just before the Fed meeting. In the daily timeframe, the coin has consolidated above the 50-day moving average and is approaching the 200-day (around $154) at current levels near $150.

Trade crypto with FXPRO today

The world’s largest investment company, BlackRock, called Bitcoin a unique tool for hedging global risks and a defence against a possible depreciation of the dollar amid the growing US federal budget deficit. At the same time, BlackRock has only $21bn in bitcoin ETFs, just 0.69% of the company’s assets in exchange-traded funds.

On 18 September, the documentary “Vitalik: An Ethereum Story” premiered in 23 countries.

US State Louisiana has integrated Bitcoin and Lightning Network, as well as USDC stablecoin, into state operations. A special service will convert incoming digital assets into dollars.

Trade crypto with FXPRO today

Commerzbank, one of Germany’s largest banks, will partner with Crypto Finance, a subsidiary of Deutsche Boerse Group, to offer cryptocurrency trading and custody services to corporate clients.

Tether called its curated stablecoin “a cornerstone in modern financial ecosystems.” USDT’s 350 million users transact with it, and its issuer works with 180 institutions in 45 jurisdictions. The report’s publication could be a response to a recent attack by consumer advocacy group Consumers’ Research.

German police seized the servers of 47 illegal cryptocurrency exchanges, which were being used by encryption virus operators, botnet owners, and darknet marketplace sellers.