The Fed’s big rate and projections cut

The Fed’s big rate and projections cut: The Fed cut the Fed Funds rate by 50bps, surprising many market analysts and aligning with the 67% probability forecasted earlier in the week. This significant change, coupled with revised economic projections, suggests a dovish shift in monetary policy. The Fed now anticipates inflation will trend towards its 2% target while adjusting unemployment forecasts upwards. As market reactions unfold, equity indices have surged, but the dollar faces pressure, with the DXY slipping towards key support levels. Explore how these developments could reshape the financial landscape and influence global central banks’ policy decisions.

The Fed’s big rate and projections cut

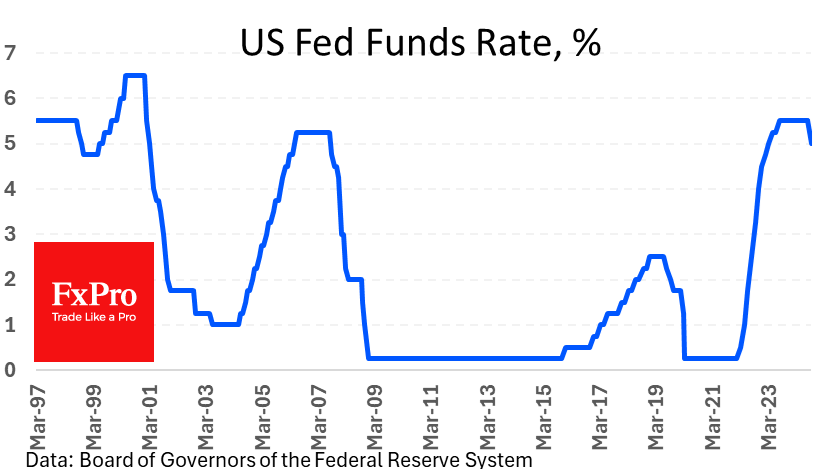

The Fed cut the Fed Funds rate by 50bps, which was in line with prevailing market expectations (the probability of such an outcome was over 67% at the beginning of the week) and surprised 104 out of 113 respondents in leading financial media polls. As the sharp cut was not fully priced in, we see a strong market reaction. This change sheds light on the Fed’s approach to monetary policy and could lead to a prolonged market correction, potentially changing the rules of the game for the dollar.

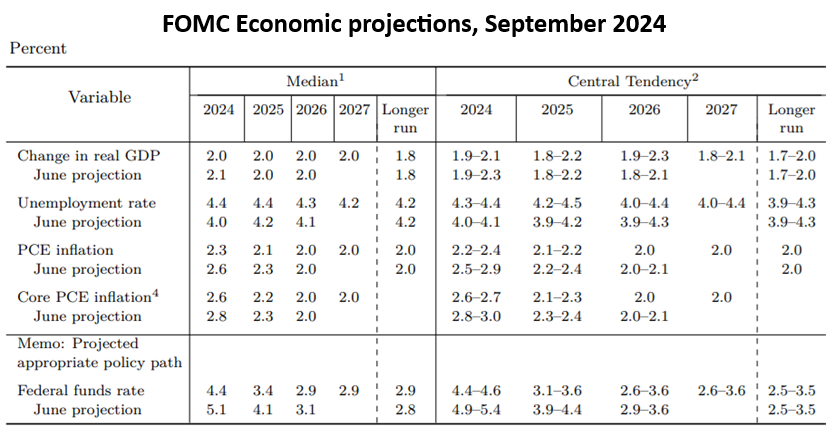

In the official commentary, the Fed pointed to a solid pace of economic growth, slowing employment growth and declining but still elevated inflation. The Fed expressed confidence that inflation would move towards its 2% target and, on that basis, moved swiftly to normalise monetary policy. Estimates for the personal consumption price index were lowered from 2.6% to 2.3% for 2024 and from 2.3% to 2.1% for 2025, against a long-term target of 2.0%. The forecast for the unemployment rate was raised from 4.0% to 4.4% for the current year and from 4.2% to 4.4% for 2025.

Sign up to trade the forex market like a savvy

In the new projections, the FOMC members identify 2.9% as the long-term neutral interest rate level (it was 2.8% in June), where they intend to take the rate in 2026 to 4.4% by the end of 2024 (it was 5.1% in June) and to 3.4% by the end of 2025 (it was 4.1%). One can see how much more dovish the Fed’s stance has become in just three months. This is most likely the result of a massive downward revision of job growth estimates for last year by over 800K.

The dramatic easing of the policy stance for this year and next is the main driver of financial markets. While the initial positive reaction was tempered by profit-taking, market behaviour on Thursday clearly showed increased risk appetite as European equity indices rallied and futures on the S&P500 and Dow Jones hit record highs. The Nasdaq100 and Russell2000 have so far lagged, even though the emerging monetary environment is potentially the most favourable for companies in these indices.

Sign up to trade the forex market like a savvy

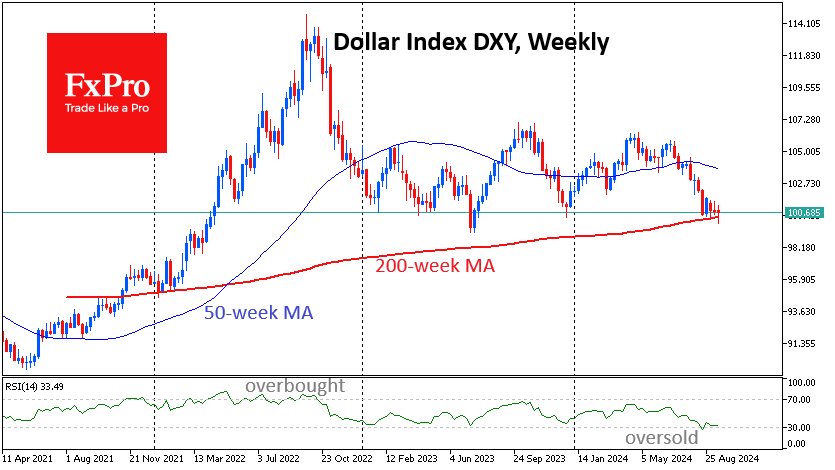

At the same time, this is dangerous news for the dollar. On publication, the DXY slipped towards the July lows, although it found temporary support on Thursday and struggled to stay above the key 100 level and 200-week moving average. The market approached these after a prolonged decline, so a bounce is likely but unlikely to change the long-term picture.

What is important to understand now is whether the Fed’s extreme softness will be an excuse for central banks around the world to follow suit at the same pace. The ECB’s Centeno, for example, had already warned on Thursday that the bank could accelerate the pace of policy easing. However, the Bank of England has yet to do so, leaving the base rate at 5.0% after cutting it in early August.