Tron has climbed to a zone of turbulence

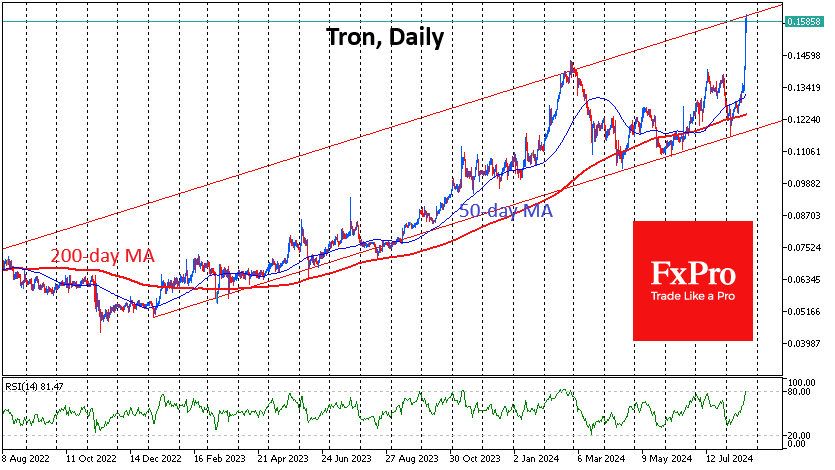

Tron Climbs to Turbulent Zone: While the crypto market fell 2.3% to $2.1 trillion, Tron defied the trend, rising 10% in 24 hours. Tron has gained 40% since early August, reaching $1.6—a key resistance level seen in May 2021. However, with an overbought RSI and historical turbulence at this level, a short-term correction is expected. Bitcoin remains stable in the $59-60K range, as institutional demand shifts toward other assets like gold

Tron has climbed to a zone of turbulence

The crypto market once again failed to break through the $2.15 trillion cap mark, falling 2.3% to $2.1

trillion, almost back to where it started Tuesday. The top coins lost between 1.2% (Doge) and 3.3%

(Ethereum, Toncoin). The main exception is Tron, which rose 10% in 24 hours.

From the technical analysis side, Bitcoin retreated to the downside after another test of its 50-day

average. The price of Bitcoin has been mostly in the $59-60K range for the past six days. Yesterday,

it seemed that the main institutional demand was for other assets, such as gold.

Tron has gained almost 40% since the lows of the 5th of August, and we saw an important

acceleration on Tuesday when the price reached $1.6. This move saw the coin return to the top 10 in

terms of market capitalisation. TRX last traded at this level in May 2021 and briefly in 2018. This is an

area of turbulence, as the coin has historically spent countless days above $1.6, so we expect a

short-term correction. Also in favour of a pullback is the overbought RSI (above 80) on the daily

timeframe, which has often preceded corrections, and the general cautious tone of cryptocurrencies.

Get connected with FXPRO today and trade your favourite cryptocurrencies like a savvy

The wave of long liquidation has dried up, so VanEck believes Bitcoin could approach an all-time high

(ATH) after the US election due to an influx of liquidity.

The Hash Ribbons indicator signals the end of bitcoin miners capitulation, which means that their

selling pressure on the market is easing, CryptoQuant noted. The bitcoin hash rate hit a new all-time

high of 638 EH/s, confirming that miners are switching to more efficient hardware.

According to Wintermute, bitcoin options show traders' optimism after the US election. The most

popular position is a call option with a strike price of $80K, which could indicate an expectation of new

highs during this period.

Bitwise notes that despite BTC’s volatility, institutional players are showing resilience. More than 60%

of the world’s top hedge funds own digital gold through ETFs.

China Supreme Court recognised transactions in virtual assets as a method of money laundering

and enshrined it in the relevant law. Measures taken in 2021 to tighten policy on cryptocurrencies and

mining led to their de facto ban in the country.