UK job market stronger than expected but weaker than the US

UK job market stronger than expected but weaker than the US: The UK job market showed unexpected strength in August, with jobless claims rising by 23.7K, far better than the forecasted 95.5K. Despite this, wage growth continues to slow, increasing just 4% year-on-year, down from previous months. While the data temporarily supported the Pound, the overall weaker UK job market compared to the US may pressure the Bank of England to ease policy, creating potential downside risks for GBPUSD. All eyes are now on upcoming UK and US economic data to determine the next market moves.

UK job market stronger than expected but weaker than the US

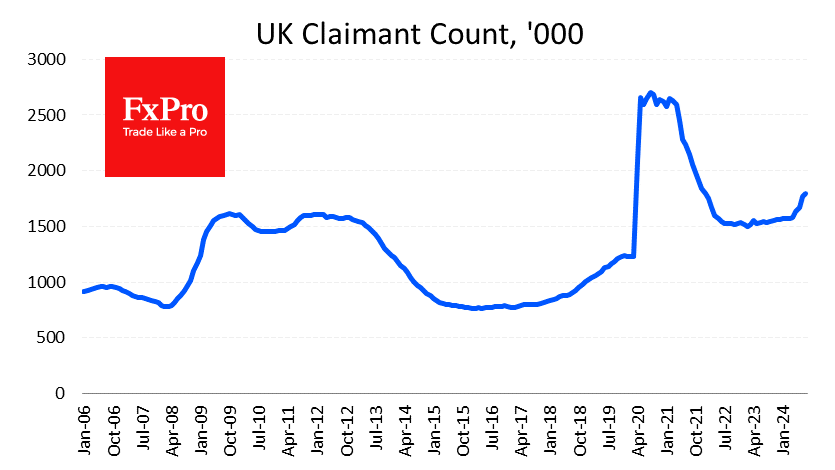

In the UK, jobless claims rose by 23.7K in August, much better than the 95.5K expected and the

102.3K rise in the previous month. This is relatively positive data as it suggests that the rate of

deterioration in the UK labour market is slowing. However, this is still the fastest claims growth since

the unemployment spike in 2020 and the 2008 financial crisis.

At the same time, wage growth continues to slow, rising by 4% year on year in the three months to

July. This is a sharp slowdown from 4.6% in the previous month and 5.7% two months ago, although

wage growth is still above inflation at 2.2% year-on-year.

The data did not change the expectations of market analysts, who still do not expect a rate change

next week but are forecasting a rate cut in November. The employment data temporarily supported

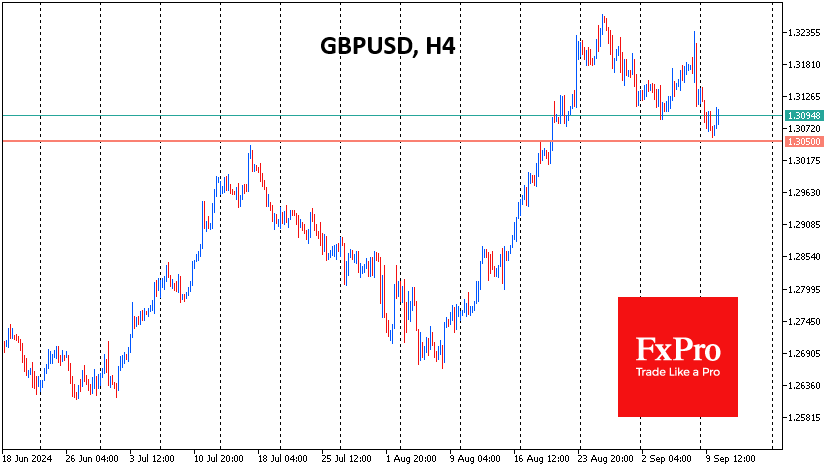

the Pound as speculators played up the positive gap between expectations and reality. GBPUSD

found support on Tuesday on the drop to the 1.3050 level, which looks like a bullish attempt to end

the corrective pullback and take the Pound into a new round of growth.

While it is wise to wait for tomorrow’s UK CPI figures, which will be released on Wednesday morning,

the main movement may be delayed until similar statistics are released from the US. For now, we can

only compare labour market figures, and the US figures look stronger. This gives the Bank of England

a greater degree of urgency to ease policy than the US, creating bearish risks for GBPUSD.