Weak Chinese data paves the way for lower yuan

Weak Chinese data paves the way for lower yuan: China’s latest economic data signals a slowdown, sparking concerns of further yuan weakness as the central bank considers stimulus measures. Industrial production, retail sales, and inflation all show signs of strain, paving the way for potential currency declines

Weak Chinese data paves the way for lower yuan

Saturday’s statistics from China added to fears of a slowdown in the world’s second-largest economy, forcing the central bank to promise additional measures to lower borrowing costs. This is a fresh attempt to reverse the deteriorating trend in the economy and support the stock market, but the Chinese Yuan exchange rate could be a victim of this policy, although it may take some time for the effect to be felt.

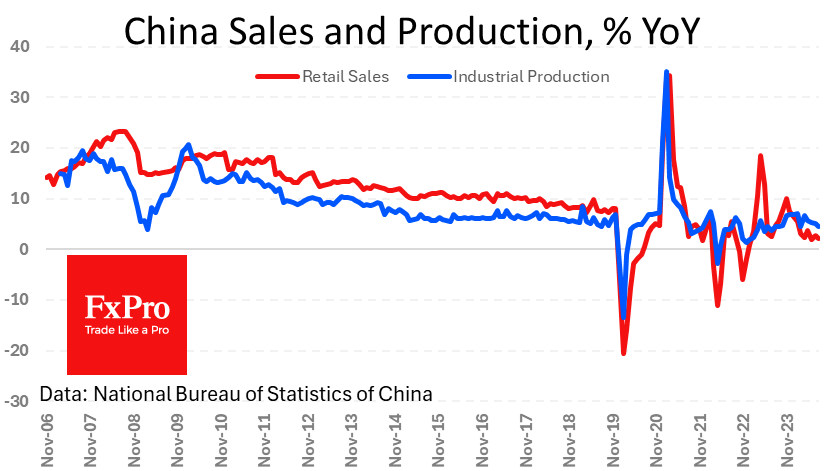

All of China’s key data released on Saturday were weaker than expected and showed a deterioration from the previous month. New home prices accelerated to 0.73% and fell to 5.3% y/y. Industrial production rose 4.5% y/y vs. 5.1% the previous month and 4.7% expected. Production last grew at a slower pace in July 20/23, and the slowing trend has been in place since April. Retail sales also rose only 2.1% y/y.

Switch to FXPRO today and trade the forex market like a savvy

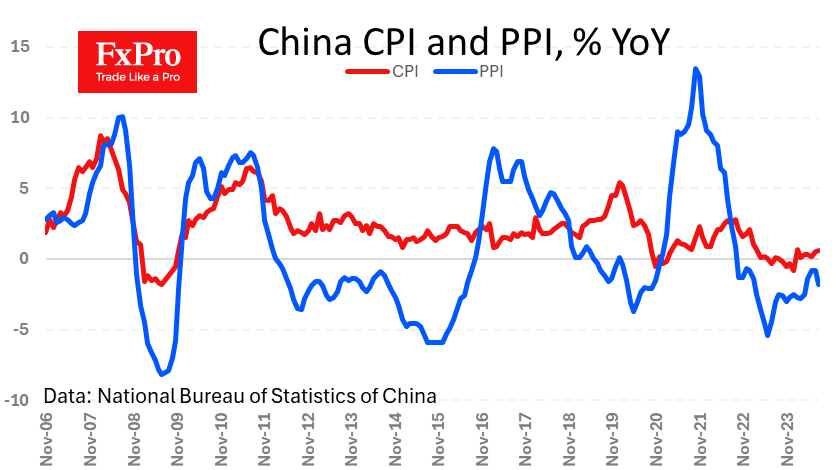

At the beginning of last week, inflation figures were released that were weaker than expected, with CPI up 0.6% y/y and PPI down 1.8% y/y. The sharp reversal in producer price dynamics indicates a new deflationary spiral in China. The inflation dynamics have paved the way for further monetary or fiscal stimulus.

The Chinese yuan has grown by 3% against the dollar since its lows in early July, but it is unlikely that its appreciation has had such an impact on the economy. Rather, this pullback is creating a favourable environment for interest rate cuts, which is a factor in the currency’s weakness.

Switch to FXPRO today and trade the forex market like a savvy

From roughly the same area, just below 7.10, the USDCNH pair reversed to the upside at the end of last year. Technical oversold conditions on the weekly timeframes suggest that the chances of a bounce are higher than those of a continuation of the decline. There are no significant technical headwinds for the USDCNH to the 7.3 area, and this weakening of the yuan has the potential to revive inflationary momentum and demand for Chinese goods.