Weak Swiss inflation paves the way for further rate cuts

Weak Swiss inflation paves the way for further rate cuts : Swiss inflation slows to 1.1% in August, paving the way for further rate cuts by the Swiss National Bank. With a strong franc and weaker inflation, more monetary easing may be on the horizon.

Weak Swiss inflation paves the way for further rate cuts

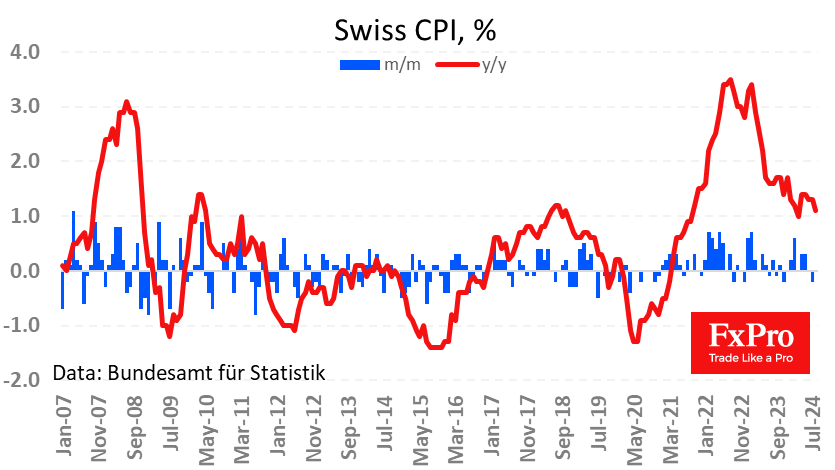

Swiss inflation slowed to 1.1% y/y in August from 1.3% the previous month, below the 1.2% expected.

In April and May, the rate of price increases rose to 1.4% y/y but later started to fall again, losing 0.2%

in the last three months.

The Swiss National Bank cut its key interest rate twice, in March and June. However, the combination

of a further slowdown in price growth and an appreciating CHF opens the door for further monetary

easing.

Get connected with FXPRO today to trade USD/CHF like a savvy

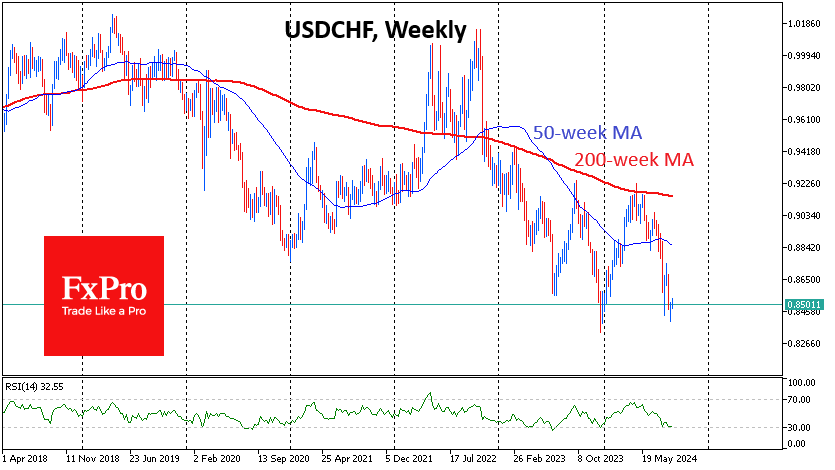

USD/CHF is back below 0.8500, its lows at the beginning of the year. The pair plunged into this area

then, as it has now, on the back of rising expectations of a Fed rate cut. At the same time, earlier

policy easing in Switzerland did not significantly weaken the franc.

The strength of the franc, which only fell below its current level in 2011, could encourage the

monetary authorities to take more aggressive steps to curb the growth of the national currency,

including warnings or actual currency intervention.

Too strong a franc hurts the economy by making exports less competitive, which could be a problem

for Switzerland’s open economy.